Student Loan Debt Relief for Millions

Aug 31, 2022

On August 24th, President Biden announced his plan to address student debt. The plan has 3 key elements:

- Debt Relief - Up to $10,000 in debt relief for individuals with loans held by the Department of Education who earn less than $125,000 and married couples who earn less than $250,000. An additional $10,000 of student debt relief is available for Pell Grant recipients.

- Longer Transition - Extends the pause on federal student loan repayments until December 31, 2022, giving borrowers more time to transition back to making payments with less risk of defaulting.

- Adjusting the Rules for Repayment:

- Capping monthly payments for current and future undergraduate loans at 5% of a borrower’s discretionary income (currently 10%). Raising the amount of income considered non-discretionary, guaranteeing that no borrower earning the equivalent of a $15 minimum wage will have to make a monthly payment.

- Forgiving loan balances after 10 years of payments, instead of 20 years.

- Covering unpaid monthly interest, so the principal balance doesn’t grow. (For example, if your minimum payment is $200, but the monthly interest is $600, instead of the remaining $400 being added to the loan balance, it’s cancelled. In this scenario, your payment wouldn’t reduce your balance, but you also won’t end up paying and still having a growing balance.)

- Public Service Loan Forgiveness program – borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government will receive credit towards loan forgiveness. This builds on temporary changes previously enacted by the Department of Education.

- Biden signed into law the largest increase to the maximum Pell Grant in over a decade and provided nearly $40 billion to colleges and universities through the American Rescue Plan, much of which was used for emergency student financial aid.

- The administration is also strengthening accountability for higher education, including undoing rules that were weakened by the previous administration. The Department of Education has reestablished the enforcement unit in the Office of Federal Student Aid and has already withdrawn authorization for the accreditor in charge during some of the worst for-profit school scandals. The agency has reinstated a rule repealed by the previous administration that holds career programs accountable for leaving graduates with lots of debt they can’t repay.

- A new annual watch list of programs with the worst debt levels in the country will be available so students can steer clear of programs with poor outcomes. Those programs will also be asked to provide institutional improvement programs detailing how they intend to bring down debt levels.

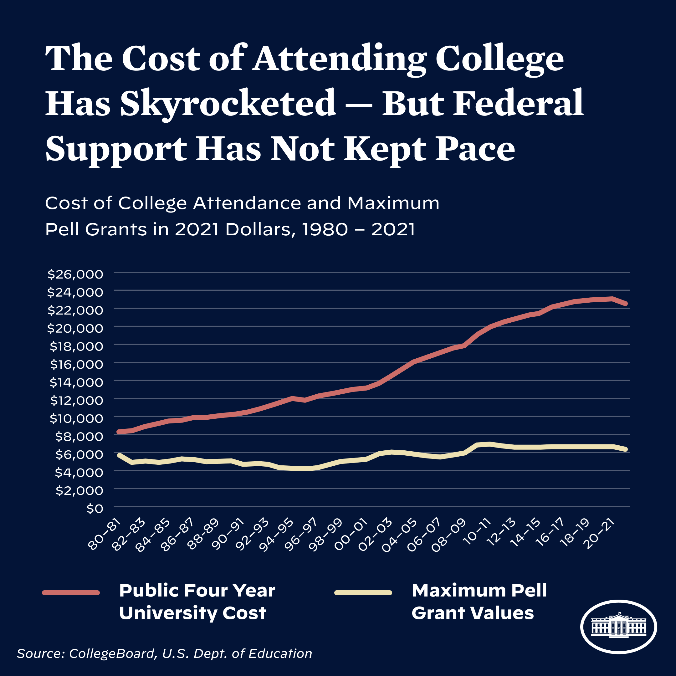

We know that the cost of colleges and universities has continued to increase despite wages and federal support through Pell Grants not keeping up.

[Graph shows that the cost of a public four-year university has increased from $8,000 in 1980 to $22,000 in 2021 while the maximum Pell Grant has stayed steady at about $6,000.]

Here is why the structure of this debt relief is so important.

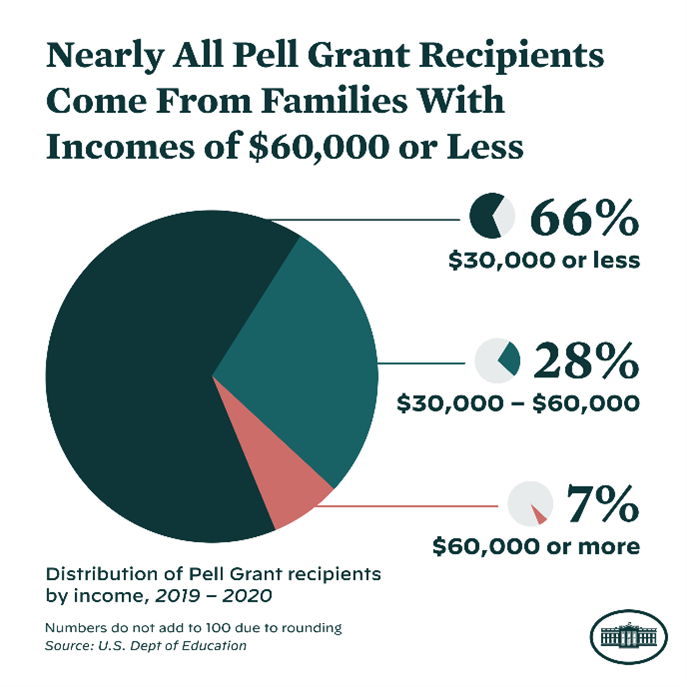

[Pie chart shows 66% of Pell Grant recipients have family incomes of $30,000 or less, 28% have family incomes between $30,000 and $60,000, and 7% earn $60,000 or more.]

Ninety-three percent of Pell Grant recipients come from families with incomes of $60,000 or less. According to the White House, “[t]he Department of Education estimates that roughly 27 million borrowers will be eligible to receive up to $20,000 in relief.”

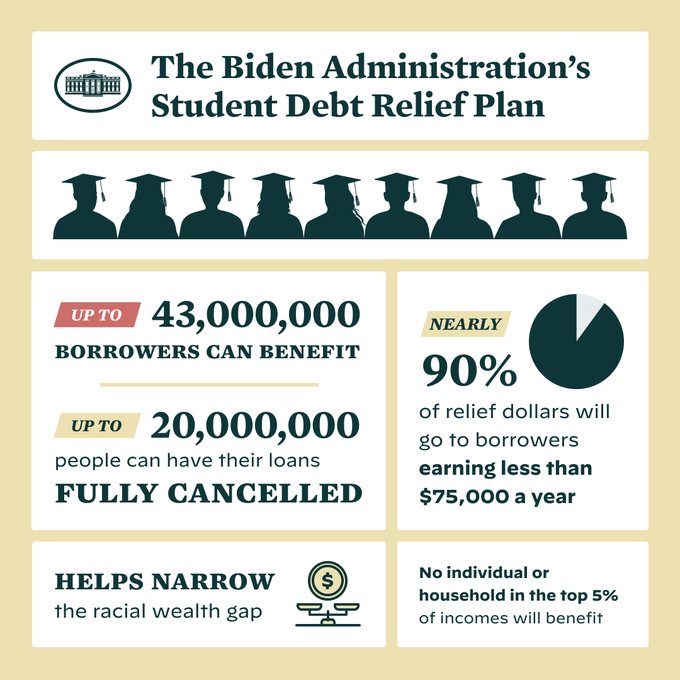

- If all borrowers claim the relief they are eligible for, 43 million people will receive debt relief, including canceling the entire remaining balance for about 20 million borrowers.

- The Department of Education estimates that for borrowers who are no longer in school, nearly 90% of relief dollars will go to people earning less than $75,000 a year.

- This policy will help borrowers of all ages. More than a third of borrowers are age 40 and older, and 5% are 55 or older.

- By offering an additional $10,000 for Pell Grant recipients, this policy helps advance racial equity. Black students are more likely to have to borrow for school and are twice as likely to have received Pell Grants than their white peers. Other borrowers of color are also more likely to receive Pell Grants.

[This plan will provide relief to up to 43 million borrowers, target low and middle-income borrowers, help borrowers of all ages, advance racial equity.]

[This plan will provide relief to up to 43 million borrowers, target low and middle-income borrowers, help borrowers of all ages, advance racial equity.]

Reactions

Most people are ecstatic at having some relief themselves or for others who will have their debts reduced or eliminated. Click the tweet below and read stories from people who will benefit and people who are happy for them.

Wait, I'm a Pell Grant recipient with $30k in loans...🥲

— Kaila Philo (@KailaPhilo) August 24, 2022

Those complaining are showing their hypocrisy. They don’t mind receiving financial relief, but they begrudge the same for others in worse financial situations. The White House Twitter account called out representatives who are opposed to student debt relief.

Congresswoman Marjorie Taylor Greene had $183,504 in PPP loans forgiven.https://t.co/4FoCymt8TB

— The White House (@WhiteHouse) August 25, 2022

Congressman Matt Gaetz had $482,321 in PPP loans forgiven.https://t.co/XPgC0pETkp

— The White House (@WhiteHouse) August 25, 2022

Cruelty Is a Feature, Not a Bug

Rep Jim Banks (R-IN) said the quite part out loud. They need poor people to stay in debt to force them into the military. If we forgive student loans, poor people might have options!

Student loan forgiveness undermines one of our military’s greatest recruitment tools at a time of dangerously low enlistments.

— Jim Banks (@RepJimBanks) August 25, 2022

Credit Where Credit is Due

Interestingly, while Vice President Kamala Harris hasn’t been featured prominently in the presentation, I’m sure her ideas influenced the outcome of the plan. When she was a presidential candidate, she called for $20,000 in loan forgiveness for Pell Grant recipients. (She also had a list of other requirements that are not included in the current plan.) But generally, this was her idea in 2019.

Interestingly here, then- Sen. Harris’ 2019 student loan forgiveness plan when she ran for president, was centered on 20K for Pell Grant recipients https://t.co/EMvSBszju9

— Jasmine Wright (@JasJWright) August 24, 2022

If You Have a Federal Student Loan

If you have student loans and qualify for debt relief, you can sign up here https://www.ed.gov/subscriptions to be notified as more information and the claims system becomes available. Enter your email and click “Federal Student Loan Borrower Updates.”

Ready to DO something right now? Download the Everyday Activism Action Pack and get started today.

We hate SPAM. We will never sell your information for any reason.